Residential Solar Tax Incentives

Sunergy Solutions

Residential Solar Tax Incentives

The residential solar tax incentives are available to support homeowners with the installation cost of installing a residential solar energy solution.

Federal Tax Credit – 3% 0Residential Clean Energy Credit

State Tax Credits/Rebates

Many states have additional incentives

Power Company Programs – Some power companies have programs ranging from $500 to $8,000 or more.

Not everyone is eligible for credits, incentives, or rebates or can fully use them. Please consult your tax professional or legal professional for further information. A Sunergy Solutions Consultant is also available to help. * Incentives are subject to change

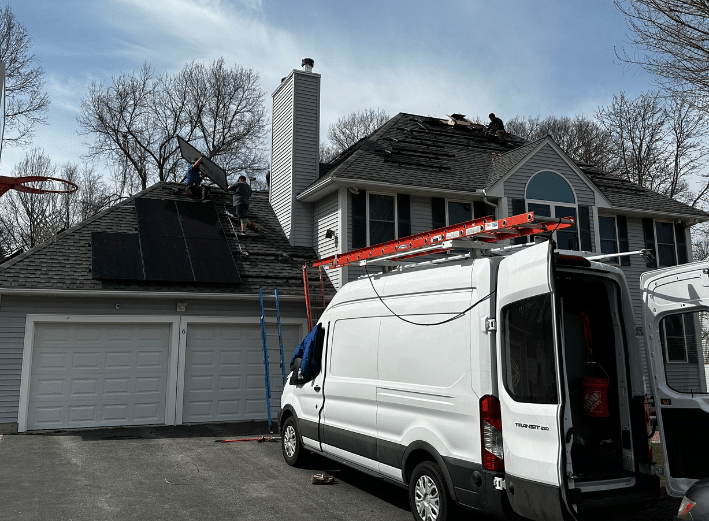

Expert Residential Solar Panel Solutions

Residential Solar Panal Installation

Sunergy Solutions is a full-service Solar provider, servicing NH, MA, RI, CT, ME, VT, NY and FL. We install the #1 selling solar panels and next generation microinverters at the most competitive price, enabling our customers to maximize production, savings and return on their investment.

We provide a 20yr workmanship warranty that compliments 25yr manufacturer warranties to ensure 100% satisfaction guarantee proven by our 5 Star Solar Reviews.

Contact Us Today To Learn More.

Sunergy Solutions

75 Gilcrest Rd., Suite 210

Londonderry, NH 03053